perspectives

2020 Mid-Year Update

We hope that you, your family, and your colleagues are healthy and safe.

These are challenging and tumultuous times for everyone, with the duration and long-term impact of the economic downturn uncertain. However, we are confident in the Spectrum team's ability to navigate this difficult environment. We have managed through several economic cycles in our 25+ year history, and the core characteristics of our strategy – investing in well capitalized, recurring revenue, internet-enabled software and information services companies – are helping to mitigate the effects of the broader economic downturn.

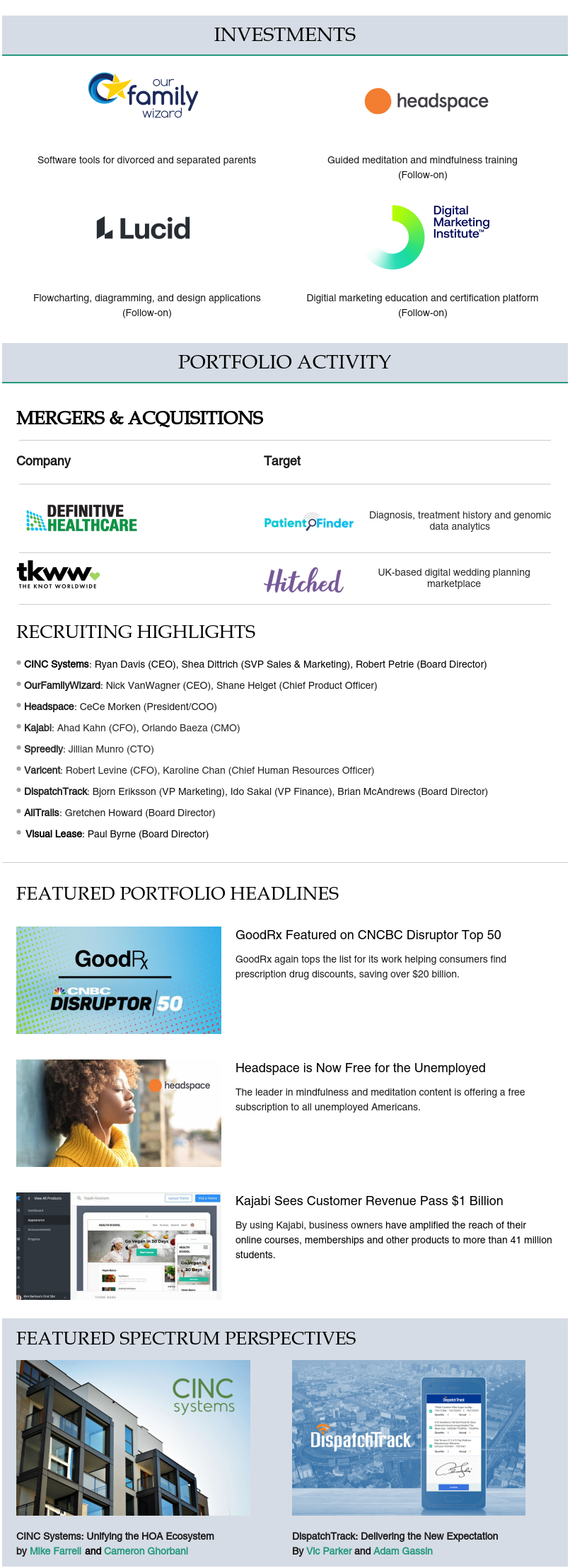

The portfolio of active companies continues to show strong resilience, and has produced sustained revenue growth and profitability in the first half of the year. We continue to make good progress in deploying capital in new and follow-on investments and across several value creation initiatives, especially in the areas of M&A and human capital recruitment.

We closed Fund IX and the second overage program at $1.5 billion and $150 million, respectively. We are deeply thankful for the support and partnership of our investors and are privileged to work with an outstanding group of colleagues, entrepreneurs and companies.

Below are select highlights from the first half of the year:

About Us

Spectrum Equity is a leading growth equity firm providing capital and strategic support to innovative companies in the information economy. For over 25 years, the firm has partnered with proven entrepreneurs and management teams to build long-term value in market-leading internet, software and information services companies. Representative investments include Ancestry, Bats Global Markets, Definitive Healthcare, GoodRx, Grubhub, Lucid Software, Lynda.com, RainKing, SurveyMonkey and Verafin. For more information, visit www.spectrumequity.com.