perspectives

Quantile: Paving the Way for a Safer Financial System

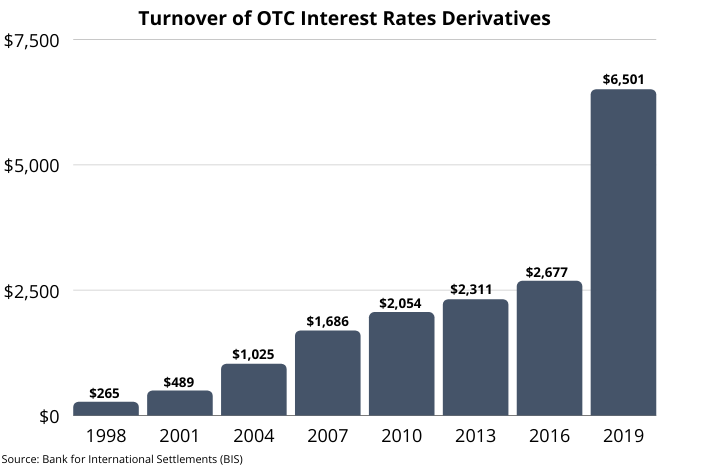

The global derivatives market has experienced significant growth over the past 20 years. The rise of these financial instruments, which derive their value from the performance of an underlying asset (e.g. stocks, bonds, interest rates, etc.), is due to a myriad of use cases, including insuring against price movements (risk management), increasing exposure to price movements (speculation) and getting access to otherwise hard-to-trade assets and markets.

The derivatives market serves a valuable role in the global economy, but the complex web of counterparty risk that these instruments create played a leading part in the Great Financial Crisis of 2008-2009. Regulators around the world have spent the last 10+ years implementing rules (e.g. Basel III, SA-CCR, UMR, etc.) to help eliminate systemic risk arising from derivative contracts. The guiding principles for new regulations have been to reduce participant’s counterparty risk and to increase capital requirements in the event of default. Our most recent investment, Quantile Technologies (“Quantile”), has a mission to make the financial system safer, and its software and services help banks, hedge funds, and other financial institutions efficiently satisfy regulatory requirements within the derivatives market.

Quantile co-founders, Andrew Williams and Stephen O’Connor, have extensive experience in the banking and financial services industries, which they continue to leverage as they guide the company’s strategic direction. Prior to founding Quantile, Andrew held senior risk management roles at Morgan Stanley for 18 years across three continents, where he had first-hand experience of the increased regulatory scrutiny placed on the derivatives market. Similarly, Stephen spent nearly 25 years at Morgan Stanley, serving in senior roles within the fixed income division, and currently serves on the Board of the London Stock Exchange. Andrew and Stephen saw an opportunity for technology to play a distinctive role in helping to eliminate risk within the derivatives market leading them to establish Quantile in 2015.

Reducing Portfolio Complexity and Improving Efficiency

The bankruptcy of Lehman Brothers in September 2008 created a cascade of problems in the financial markets, and global financial institutions no longer trusted the credit worthiness of their counterparties. This led to regulators forcing banks to increase capital requirements and reduce counterparty risk through various rules and regulations implemented over the past decade. Quantile currently offers two solutions focused on the OTC derivatives market, and they are designed to enable financial institutions to collaboratively reduce risk via Quantile’s centralized platform.

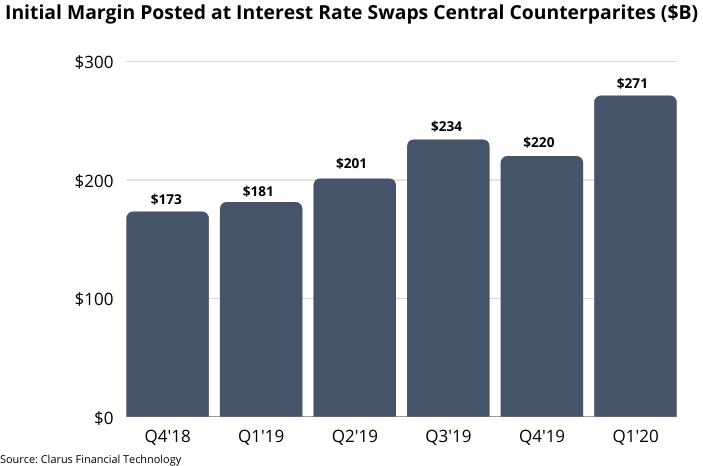

Quantile’s first service, Initial Margin Optimization, is designed to reduce counterparty risk and the costs associated with funding initial margin. Initial margin is required to cover potential losses in the event of default. Initial margin requirements are significant and increasing (sometimes north of $1 million for a single trade) given the large size and long maturity profile of OTC derivative trades. Each month, Quantile’s optimization service reduces billions of dollars of initial margin across multiple asset classes.

Quantile’s second service, Interest Rate Compression, allows participants to reduce the number of individual trades and overall gross notional outstanding of their derivatives portfolio by offsetting or “netting” trades. Gross notional outstanding, the total value of all derivatives contracts, is an important figure for financial institutions to monitor as regulators calculate capital requirements based on those values. Given the increased use of derivatives, gross notional outstanding has grown rapidly over the past few years, surpassing $1 quadrillion in 2018.

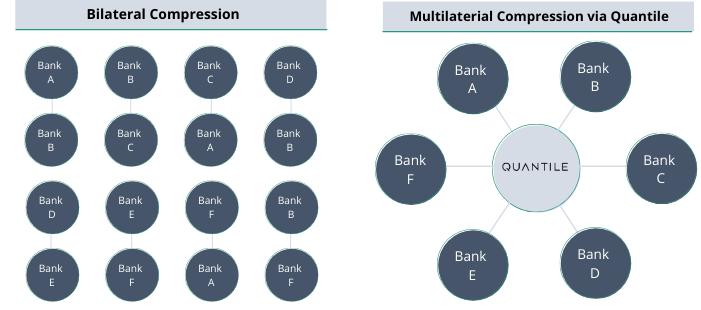

Without a trusted third-party platform like Quantile, banks have to compress bilaterally (one-to-one), an inefficient and unoptimized process. Quantile enables multilateral compression, allowing a broader number of counterparties to participate in a single compression. Because banks are long and short on many different positions, the greater number of participants, the higher likelihood that more derivatives can be compressed, creating a powerful network effect and value proposition for all involved. As new customers join Quantile’s platform, all participants benefit from the increased probability that more trades can be compressed. From 2017 to 2020, Quantile’s compression service has eliminated more than $230 trillion of gross notional outstanding.

Expanding Our FinTech and Risk Analytics Franchise

We’re thrilled to support Andrew and the entire Quantile team as their first institutional investor. As we’ve highlighted, Quantile exhibits many characteristics that we often seek in new investments: strong regulatory tailwinds, experienced co-founders and management, a compelling network-driven business model, significant customer ROI, and a product led growth strategy. We’re excited to add Quantile to Spectrum’s successful FinTech franchise and look forward sharing and implementing lessons learned from previous investments at Quantile.