perspectives

SavvyMoney: A ‘Win-Win’ Credit Score Solution for Consumers and Financial Institutions

We’re excited to announce our growth investment in SavvyMoney, a fintech innovator enabling banks and credit unions to better serve consumers by powering credit score solutions, financial wellness tools, and personalized offers.

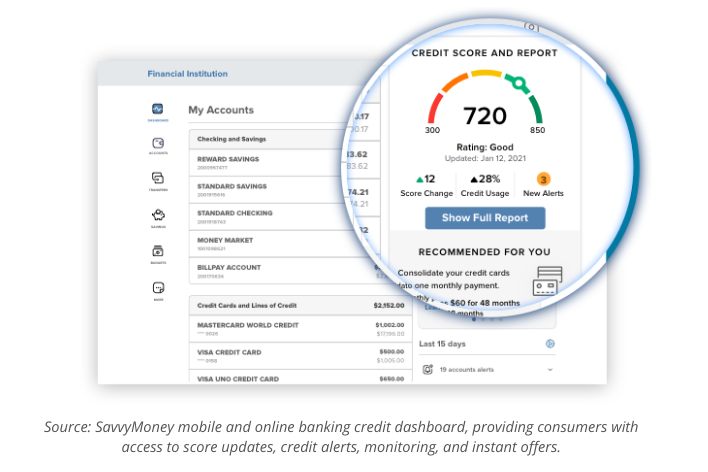

Integrated into the online and mobile banking portals of its partner financial institutions, SavvyMoney’s dashboard makes it easy for consumers to analyze their credit scores, understand factors that impact it and the actions they can take to improve their scores over time. Consumers also gain access to SavvyMoney’s powerful recommendation engine, which displays personalized digital loan offers from their banking institution, ensuring they always know the best rates that they can access.

SavvyMoney is a rare example of a true ‘win-win’ for both consumers and financial institutions in the fintech world. The vast majority of consumers who opt-in to the service see an improvement in their credit scores and many choose to take advantage of loan and refinance offers over time to reduce rates or monthly payments. Banks and credit unions in turn gain access to a powerful, credit data-enabled platform that advances their digital platform and lending capabilities, builds consumer insights and loyalty, and allows them to compete more effectively with the likes of CreditKarma.

We’re thrilled to have this opportunity to partner with CEO JB Orecchia, a pioneer in the consumer credit score space, and strategic partner and co-investor Transunion. We believe that SavvyMoney is uniquely positioned to become a key digital enabler for financial institutions everywhere. With a platform 100 percent focused on banks and credit unions and their end consumer account holders, the company has achieved remarkable success to date, today reaching 20 million consumers at 796 financial institutions, and nearly 3x growth over the past 2 years.

SavvyMoney is a terrific fit for Spectrum, given our past track record partnering with innovative bank technology companies like Mortgagebot, iPay Technologies and Verafin and active portfolio company Empyrean Solutions, and we’re looking forward to working closely with the SavvyMoney management team to execute on their ambitious growth strategy.