perspectives

Zenwork: Powering Digital Tax Compliance and Regulatory Reporting for Businesses Everywhere

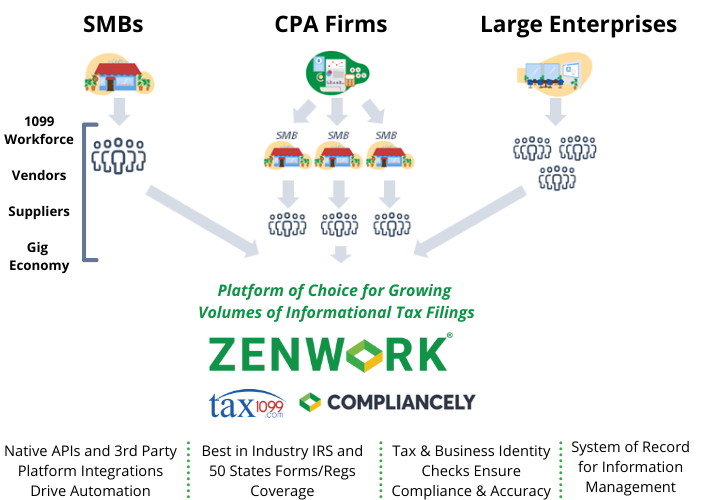

We’re thrilled to announce our investment in Zenwork, the market-leading provider of digital tax compliance software to 100,000+ SMBs, including 30,000 CPA firms, and large enterprises across the country. Our $163 million growth transaction in the Fayetteville, Arkansas-based company is the largest growth equity funding in Arkansas in recent years and represents another example of Spectrum Equity’s core belief that great, capital-efficient businesses can be built anywhere, and frequently exist outside of the traditional Bay Area and Northeast tech hubs.

When we first met founder and CEO, Sanjeev Singh, in 2018, we were immediately impressed by what he and his team had built. The bootstrapped business automates a pervasive informational tax and regulatory compliance pain-point for businesses of all sizes. Like the leaders of other mission-led RegTech companies we have partnered with, including Trintech, Verafin and World-Check, Sanjeev built Zenwork with a relentless focus on addressing the compliance, workflow, and automation needs of his customer base. Over the course of our three-year relationship, we have been impressed by the company’s continuous innovation as they have launched new, successful products to help businesses manage their evolving tax and compliance needs.

The product suite that Sanjeev and team have built eases the time- and resource- intensive burdens of state and federal tax compliance. Zenwork provides businesses e-filing and information management solutions for various tax forms via its market leading platform, Tax1099. Tax1099 helps businesses of all sizes, including a range of customers like DistroKid, Eide Bailly, Rover, and UC Davis automate the informational tax filing processes for over 40 distinct tax forms, featuring integrations with leading online accounting and payroll systems and seamless e-filing with state and federal tax bodies. The platform ultimately serves as the system of record for businesses to manage the tax information for their contracted workforce, vendors, and suppliers year-after-year, resulting in strong customer renewal rates.

Zenwork’s success has been driven by product innovation and brand leadership -- high NPS customers who refer the product to friends, close affiliations with CPA firms where businesses learn about Zenwork capabilities, and loyalty with online accounting vendors who consider it the platform of choice. And the company has grown rapidly, taking advantage of positive macro conditions created by the long-term growth trends in the 1099 workforce, where any business that works with non-fulltime employees needs to file information tax forms on these parties to stay in good standing.

According to the IRS, over 75 million 1099-Misc forms are e-filed annually, up 25% from 60 million in 2015. As more and more businesses look to adopt technology to self-manage this tax filing pain-point, we believe Zenwork will be the partner of choice for SMBs and enterprises alike.

We’ll be investing heavily in Tax1099 to keep pace with a dynamic regulatory environment and the rapid growth of the gig economy workforce, which is creating really exciting volume growth for Zenwork, as they are uniquely well suited to work with large digital native customers given their modern API-native platform.

Over the past few years, the Zenwork team has also leveraged its domain expertise processing tax information for 100,000 companies and business partners each year to develop new products, including a powerful, high volume business compliance and identity verification platform, Compliancely, that has transformed the manual, time-intensive processes of validating tax ID and business entity information. Compliancely has emerged as an innovator in the merchant onboarding, Know-your-Business (KYB), Ultimate Business Owner (UBO) compliance technology world and is now working with some of the world’s leading e-commerce, payments, and identity verification platforms to address high volume, real-time use cases. We expect to continue investing in this platform to build out new capabilities and additional complementary offerings to further streamline other tax and business identity screening processes.

We’re delighted to announce this new investment and excited to partner with Sanjeev and the rest of the Zenwork team to continue to innovate in the informational tax, regulatory reporting and business identity categories.