perspectives

Ease: Modernizing Benefits Management for SMBs

The Employee / Employer

The term “Open Enrollment” typically evokes the season when employees have to take time away from pressing work priorities to re-educate themselves on foreign terms like “deductible”, “co-insurance”, and “HSA”, before making binding, year-long decisions on complex medical, dental, and ancillary benefits insurance products for themselves and their loved ones.

Despite the ubiquity of mobile phones and modern software, many employees accessing benefits through their employers still wade through Open Enrollment in-person, filling out lengthy paper forms with a non-zero chance of making errors or forgetting required information. And if you are one of the 60 million people working at one of our nation’s 6 million small businesses, you likely navigate this process without the benefit of an experienced HR leader to guide you through these critical personal medical and financial decisions. At best, an error during Open Enrollment means a misspelled name on your insurance ID card. At worst, it means insufficient coverage and surprise costs.

As an employer, you want better resources for your employees, but how can you afford the incremental expense of an HR leader savvy in benefits, or find the budget for expensive HR software?

Broker: Trusted Advisor to SMBs

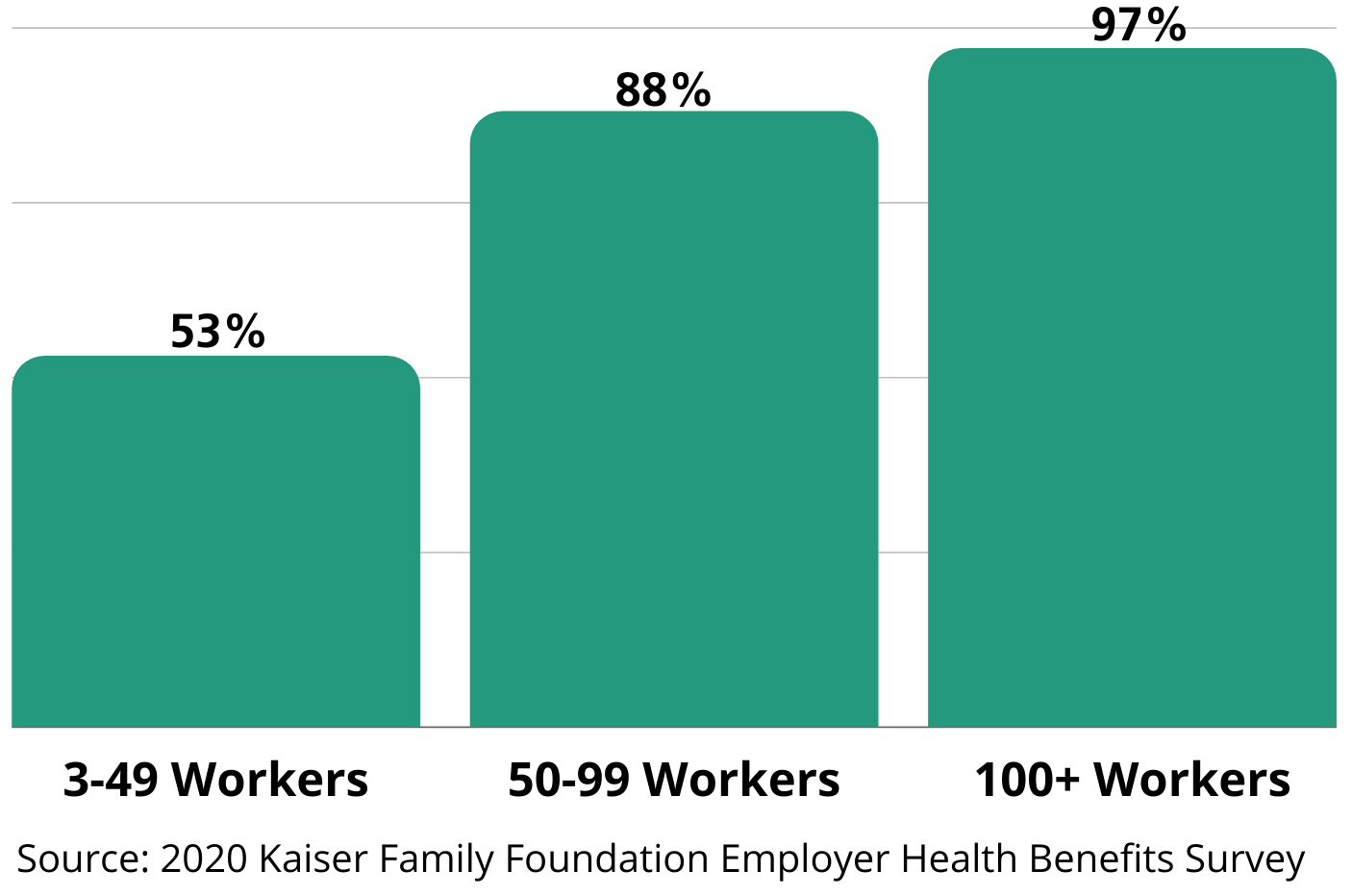

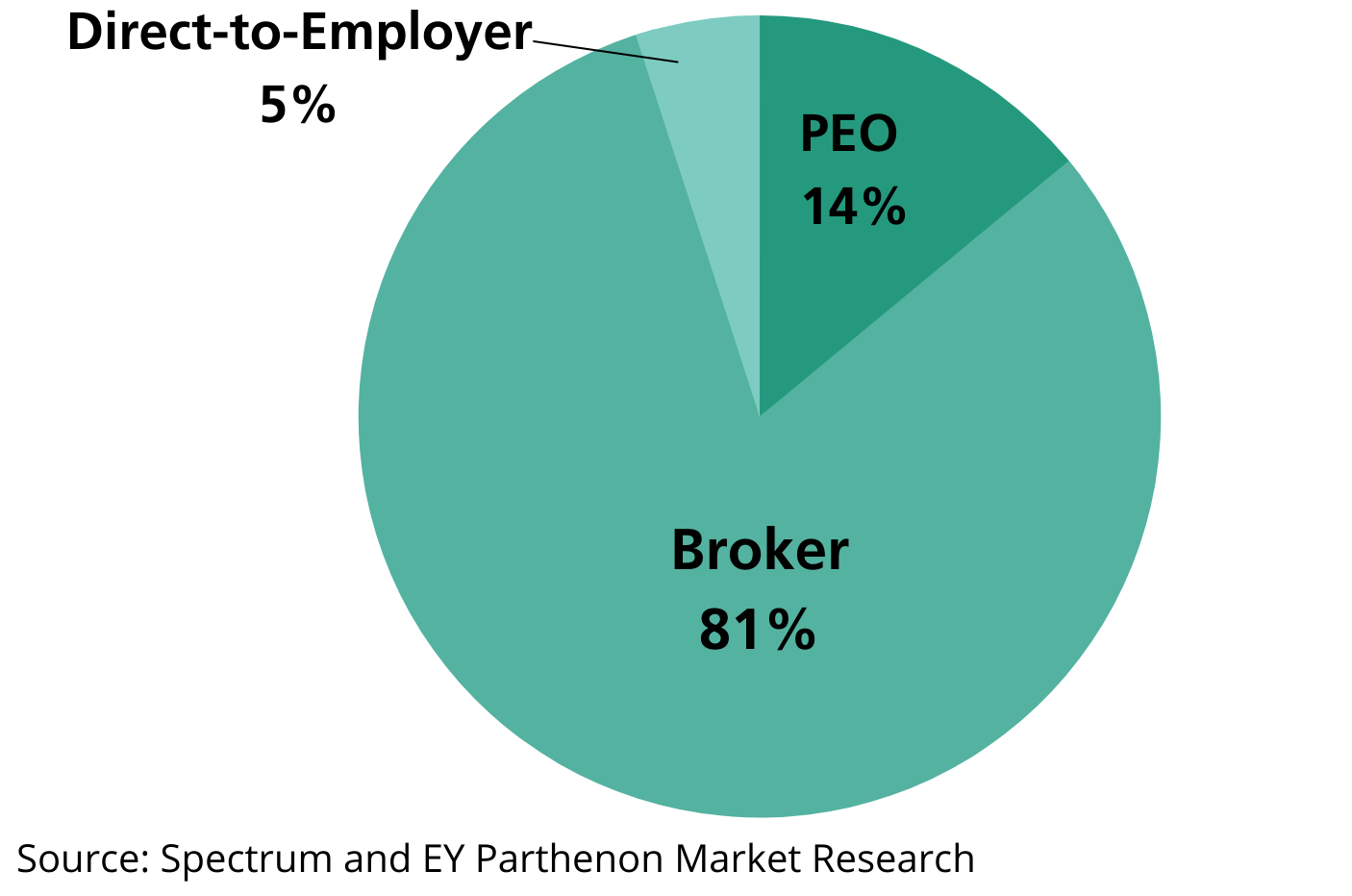

Fortunately, employers haven’t managed benefits selection alone -- thousands of licensed and trained insurance brokers serve as trusted advisors to small and large businesses, helping employers and their employees navigate the complexity of benefits. Today, over 80% of small businesses work with insurance brokers to manage their benefits. These insurance brokers serve as a key intermediary between insurance carriers seeking to access a widely dispersed SMB population, which often lacks dedicated personnel and technology budgets to fully self-direct critical insurance decisions.

The insurance brokerage industry has undergone dramatic changes -- changes mandated by the Patient Protection and Affordable Care Act (the “ACA”) have driven broker commissions down, client expectations have increased, private equity-backed national platforms have taken market share, and more recently, several well-funded startups have sought to outright disintermediate the insurance broker from its important role in the benefits value chain. This, paired with the broader consumerization of healthcare and increasing consumer demands, has created a void within SMB benefits.

Ease: Trusted Cloud-Based, Central Platform

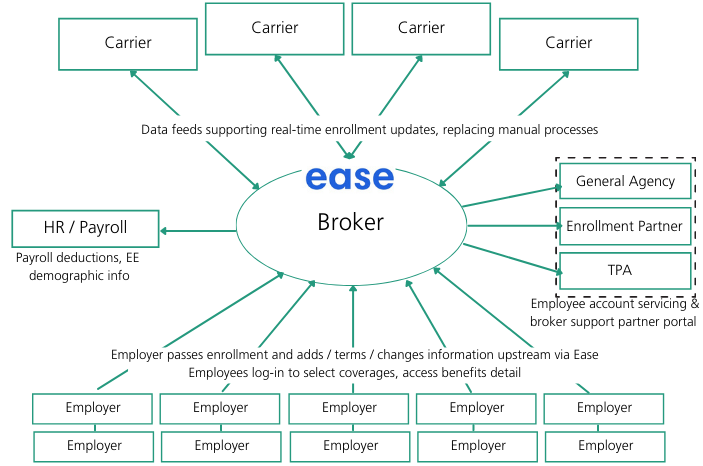

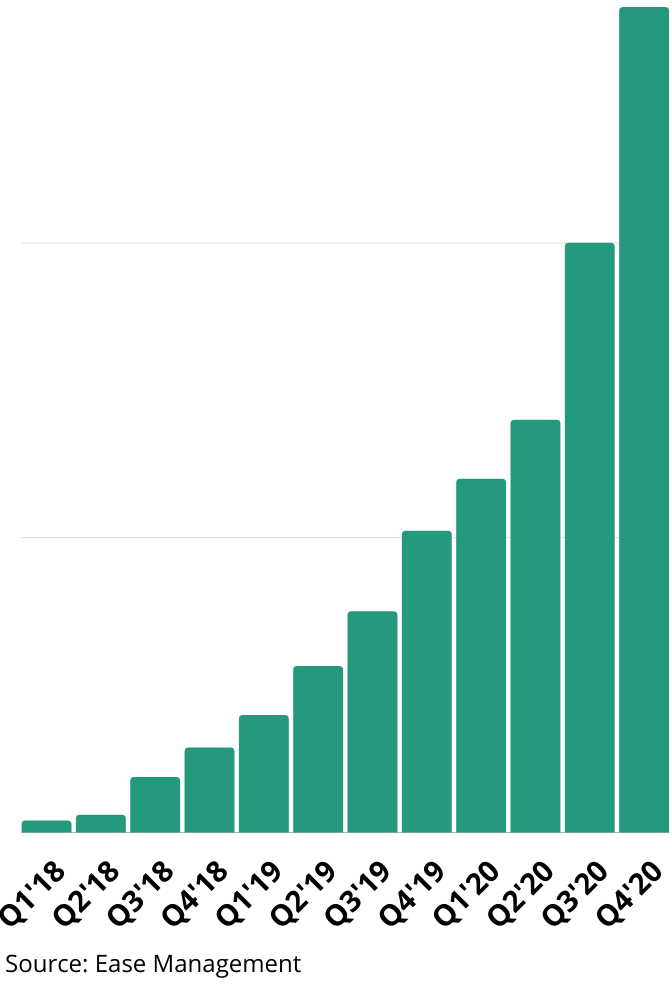

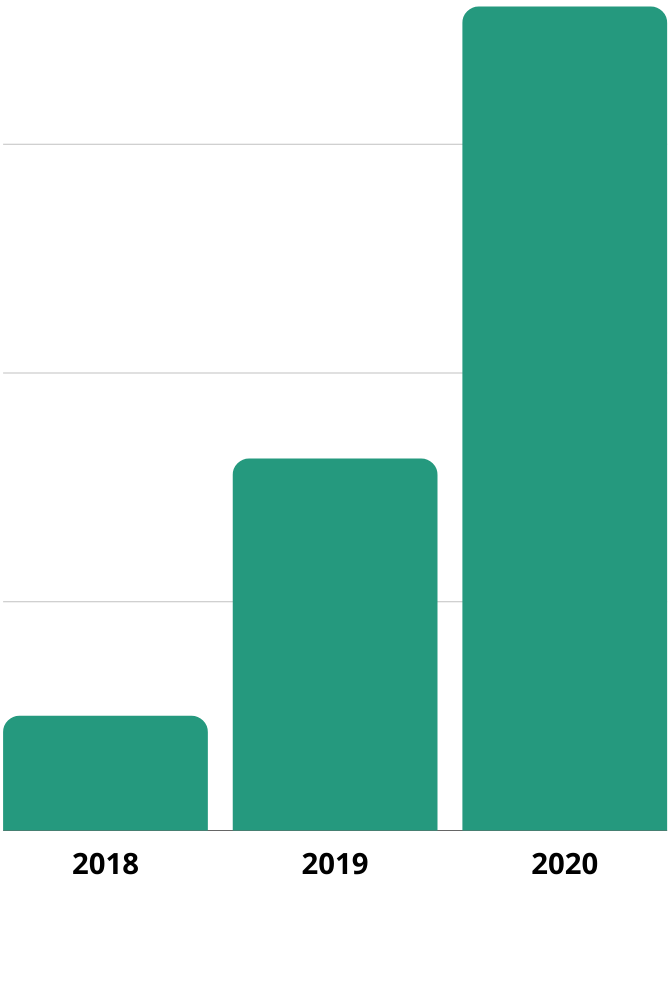

Enter Ease. Ease is the leading provider of SaaS benefits enrollment, administration, and HR software to SMBs (<500 FTEs), working directly with insurance brokers to help even the smallest companies modernize their benefits administration tech stack and employee experience. Ease supports brokers working at one-person agencies all the way up to the largest national brokerage firms -- over 40% of the top 100 insurance agencies use Ease. Those brokers have deployed Ease into over 75,000 small businesses, supporting fully-digitized adds, terms, and changes to enrollment and housing benefits information for millions of employees. Ease’s footprint of brokers has grown rapidly -- by using Ease, brokers eliminate time-consuming paperwork and instead focus on building and retaining their book of business.

Ease’s simplified, consistent, and modernized benefits experience helps to deepen client relationships. Employees have a much easier time navigating and selecting the benefits they’d like to obtain, employers are relieved to have a modern software platform to manage, administer, and track all employee benefit information, and brokers are able to create an overall enhanced customer experience for their employer groups, while automating much of the pen-and-paper headaches and allowing those brokers to win and retain customers. The Ease solution is intuitive to use yet powerful in the value it creates for all parties involved.

Ease was founded through the marriage of deep category expertise and modern software development capability. Co-Founder David Reid (CEO) has over 30 years of experience within small group benefits, and Co-Founder Courtney Guertin (CTO) has been developing software solutions for over 20 years. That heritage reflects in the company’s mission -- use technology to streamline widely inefficient, manual, and paper-based processes across the entire benefits value chain. By strategically inserting themselves as a point of connectivity between businesses, brokers, and insurance carriers, Ease has become the automation engine and source of truth for all market constituents.

Automating the Flow of Information and Premium Dollars to Carriers

Ease’s scale and rapid growth has attracted the attention of major insurance carriers who have since built direct electronic connections to Ease. These connections enable more efficient onboarding of small employer groups to all of a carrier’s products (health, dental, medical, etc.) and support billions of insurance premium dollars today. For Ease’s carrier partners, direct connections reduce paper-based enrollment and maintenance processes, drive greater enrollment persistence, and reduce the friction to obtaining coverage. These benefits have tangible value; ACA regulation in the small group market has effectively capped health insurance company profits, increasing the importance of automation to serve the SMB market profitably.

Brokers, employers, and employees benefit downstream -- electronic connections reduce data entry errors and make adding or changing coverages and increasing participation near-frictionless. No more waiting 30+ days for your insurance ID card, and no more misspellings on it either!

Expanding our Insurtech and SMB Software Franchise

We are thrilled to partner with David, Courtney, and the entire Ease team in support of their continued rapid growth and adoption within the small group benefits ecosystem. Ease demonstrates many characteristics that we seek in new investments: experienced co-founders and management, market leadership, rapid growth and attractive financial profile, highly-persistent customer relationships, multi-sided value proposition driving material customer ROI, and compelling forward opportunity. Our market diligence work showed that the SMB insurance and benefits market remains antiquated and highly fragmented, and we believe the solution lies in SMBs’ close partnership with insurance brokers and other existing market constituents.

Our investment in Ease is a continuation of two main themes for Spectrum over the past decades, namely

pursuit of companies providing technology-driven innovation for the insurance industry such as Arrowhead (acquired by Brown and Brown), NetQuote (acquired by Bank Rate) and Origami Risk, and

software and internet companies serving the operational needs of SMBs. Our SMB software experience spans both verticalized solutions (CINC Systems, iPay, and Verafin within FinTech), and applications targeting horizontal end markets (SurveyMonkey, Lucid, Kajabi, Jimdo, and many others).

We’re excited to add Ease to Spectrum’s InsurTech and SMB software franchises!

If you’d like to learn more about the company, read the press release about Spectrum’s partnership with Ease.