perspectives

Empyrean Solutions: Empowering the Financial Institution CFO

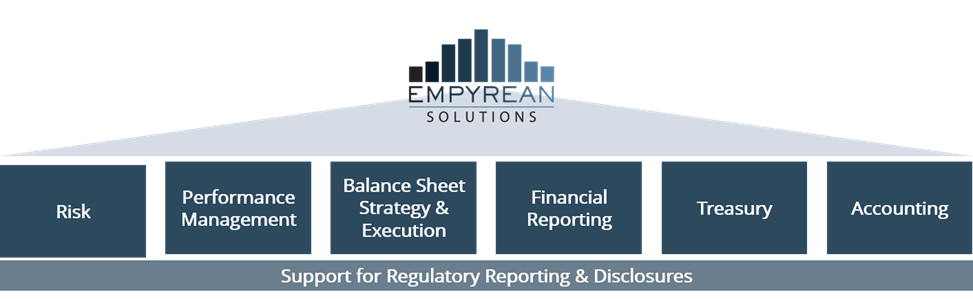

The financial institution CFO’s job is never easy and is constantly evolving. The CFO is deeply involved in setting long-term strategy, responsible for capital allocation decisions and ongoing adjustments to the plan to execute on the strategic vision, and acts as the principal point of contact of investors, board directors and regulators alike, all while meeting financial and regulatory reporting requirements and managing risk to ensure the long-term stability and health of the institution. Critical to a CFO’s success in navigating this myriad of roles is effective asset and liability management (ALM).

Effective ALM requires that the CFO proactively manage assets and cash flow to cover outstanding liabilities and obligations. This may seem like a straightforward mandate, but when you take into consideration business factors such as changes in deposit base and other sources of funding, growth and contractions of lending business lines, and external market conditions like interest rate volatility, capital markets and currency risk exposure, the situation becomes increasingly complex. CFOs are actively looking for modern software solutions that enable strategic balance sheet management and help them make better business decisions, ensure regulatory compliance and manage risk.

This is where Empyrean Solutions can help. Empyrean has grown rapidly to now serve over 100 leading banks and credits unions across North America. The company’s products include its flagship ALM solution, liquidity stress testing, deposit analytics, funds transfer pricing, and capital planning and stress testing. The company has an active product roadmap of new offerings in the works; all of which have a singular focus on empowering the office of the financial institution CFO.

Built by financial and risk management practitioners with deep domain expertise, Empyrean has an easy-to-use interface, powerful data processing and advanced modeling capabilities, and a commitment to ongoing product innovation that has distinguished the company from the competition. Empyrean has seen significant market adoption from both institutions swapping out legacy software point solutions as well as banks and credit unions looking to move ALM functions in-house, rather than rely on outsourced services.

When we first met CEO Chris Maclin and the rest of the team, we were impressed not only with their breadth of knowledge, but also with their clear vision about the future of ALM and risk management. It was immediately apparent that this team had a mission-driven approach to improving the office of the CFO through its product innovation and strategy.

We’re thrilled to partner with Chris and the entire Empyrean team as their first institutional investor. Empyrean is a perfect fit for Spectrum given our FinTech domain expertise and portfolio experience investing in both enabling bank and credit union technology (iPay Technologies, Mortgagebot, ExactBid) and risk management (Quantile, RiskMetrics, World-Check, Verafin), and we are excited to work closely with the team to leverage lessons learned from these portfolio companies and others as they execute on their vision to empower the financial institution CFO.

If you’d like to learn more about the company, read the press release about Spectrum Equity’s partnership with Empyrean.