perspectives

Membersy: Powering Price Transparency and Affordability in Dentistry

We’re thrilled to announce our investment in membersy, a fast-growing membership platform connecting dentists and patients.

When we first became acquainted with membersy in 2019, we were impressed by the company's efforts to modernize the way dental practices manage membership plans to serve their patients. Our experience investing behind vertically focused companies that are digitizing historically offline, inefficient, paper-based processes gave us conviction in membersy’s business and market-leading technology platform. We were also excited about the company’s commitment to price transparency and expanding access to quality, affordable care – a theme we have invested behind for several years within our digital health portfolio, which includes investments in GoodRx, Payer Compass, and Everly Health.

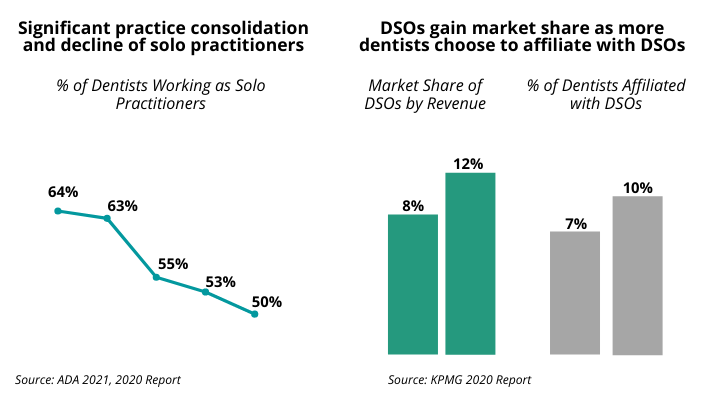

The company’s growth has been underpinned by several factors, including rising costs of dental care and an increase in fee-for-service patients. In addition, the consolidation of individual dental practices into dental groups or dental service organizations (DSOs) is accelerating membersy’s market opportunity.

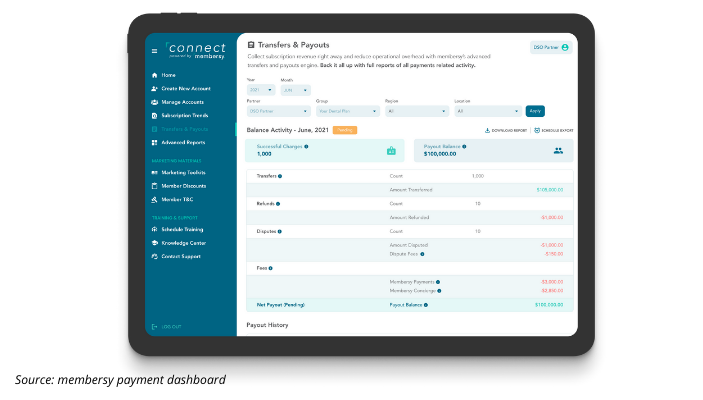

Membersy helps dental groups address these challenges. The company works with their partner dental groups to clearly outline fee-for-service pricing for various treatments and procedures so that consumers can make informed decisions when considering dental care, and don’t get hit with an unexpectedly large bill after a visit. Membersy has also streamlined what has historically been a card-based, paper-based process of enrolling in membership plans and administering benefits. Importantly for large dental groups managing multiple offices, the company supports and streamlines compliance with various pricing regulations and insurance contracts that are unique to each state.

Over time, we witnessed firsthand the strength and resilience of the business. Through the pandemic, which forced many dentist offices to close or operate with limited capacity, membersy continued to support their partners by providing vital membership offerings that helped their partner dental groups retain consumers at a time when consumer visits were declining. When many consumers lost employer-sponsored dental benefits or saw their disposable income decrease, membersy provided quality, affordable options. Since its founding, membersy has garnered the trust of 4,000+ dental practices, supporting 13 of the top 30 DSOs and nearly 1 million members across 41 states.

We are excited to partner with the management team and welcome new board members Dr. Chad Wise and Keith English, both industry veterans in their own right, to help us support the company’s next phase of growth. We believe that subscription commerce for dentistry is powering price transparency and affordability for consumers, and membersy is driving this transformation. We look forward to working together to further innovate the dental industry.