Spectrum News| July 2024

Spectrum Equity Announces 2024 Mid-Year Team Promotions

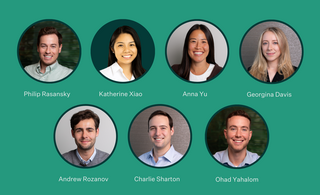

Boston, San Francisco, and London, July 2, 2024 – Spectrum Equity is pleased to announce mid-year promotions for seven members of our investment team.

Philip Rasansky has been promoted to VP; Kat Xiao and Anna Yu to Senior Associates; and Georgina Davis, Andrew Rozanov, and Charlie Sharton to Associate.

Philip Rasansky to Vice President

Phil joined Spectrum as an Analyst in the summer of 2018 having subsequently been promoted to both Associate and Senior Associate. Over his years at the firm, Phil has established himself as a thematic-driven sourcer with a keen understanding of what distinguishes a great Spectrum company, highlighted by his work in support of Empyrean, In Tandem, and Bitly.

Kat Xiao to Senior Associate

Kat joined our Boston team as an Analyst in 2020 and was promoted to Associate in 2022. Kat has an eye for finding great businesses and her execution skills are exceptional. Across the portfolio, Kat is actively involved with Zenwork and SavvyMoney, becoming a valued partner to each management team.

Anna Yu to Senior Associate

Anna joined our SF team as an Associate last August after spending time at both JMI and RBC. She has hit the ground running since joining, setting the pace on origination activity and serving as an integral member of multiple live deal teams.

Georgina Davis to Associate

Georgina joined our Boston team as an Analyst in 2022. She quickly established herself as a creative and consistent sourcer with a unique ability to find high quality companies. Georgina has excelled in her execution work on several live transactions, many of which she originated.

Andrew Rozanov to Associate

Andrew joined our SF team as an Analyst in 2022 after a productive summer internship in 2021. Andrew has brought genuine intellectual curiosity and an unwavering work ethic to all facets of the analyst role across origination as well as deal execution work.

Charlie Sharton to Associate

Charlie joined our Boston team as an Analyst in 2022. He has brought a contagiously positive attitude and consistent work ethic to the Analyst role.

Ohad Yahalom to Associate

Ohad joined our Boston team as an Analyst in 2022. He has distinguished himself as a tenacious cold caller and trusted resource on diligence, having played a key supporting role on the VBA investment process as well as In Tandem’s acquisition of FamilyWall.

About Spectrum Equity

Spectrum Equity is a leading growth equity firm providing capital and strategic support to innovative companies in the information economy. For over 30 years, the firm has partnered with exceptional entrepreneurs and management teams to build long-term value in market-leading internet-enabled software, data, and information services companies.

With offices in Boston, San Francisco, and London, the firm is investing its tenth fund with $2 billion in limited partner capital. Representative investments include Ancestry, AllTrails, Definitive Healthcare, GoodRx, Lucid Software, Origami Risk, SurveyMonkey and Verafin. For more information, including a complete list of portfolio investments, visit our Portfolio page.

The content on this site, including but not limited to blog posts, portfolio news, Spectrum news, and external coverage, is for informational purposes only and does not constitute investment advice. Use of any information presented is at your own risk. Spectrum Equity is not responsible for any content reposted above from any third party website, and has not verified the accuracy of any third party content contained above. Spectrum Equity makes no guarantees or other representations regarding any results that may be obtained from use of this content. Investment decisions should always be made in consultation with a financial advisor and based on individual research and due diligence. Past performance is not indicative of future results, and there is a possibility of loss in connection with an investment in any Spectrum Fund.

Inclusion in any third-party list, award, rating, ranking, or other recognition is not indicative of Spectrum Equity’s future performance and may not be representative of any investor’s experience. To the fullest extent permitted by law, Spectrum Equity disclaims all liability for any inaccuracies, omissions, or reliance on the information, analysis, or opinions presented.